Many people think that filing for personal bankruptcy is very complicated and difficult, but you can find many books and other resources to help you navigate through the process. If you are a reside in the state of Wisconsin consider speaking with a Milwaukee Bankruptcy Attorney. Filing bankruptcy is a big decision, and before you make up your mind, read the tips below to see if bankruptcy is right for you.

Many people think that filing for personal bankruptcy is very complicated and difficult, but you can find many books and other resources to help you navigate through the process. If you are a reside in the state of Wisconsin consider speaking with a Milwaukee Bankruptcy Attorney. Filing bankruptcy is a big decision, and before you make up your mind, read the tips below to see if bankruptcy is right for you.

You should look into and understand which debts are eligible to be written-off under bankruptcy. There are certain loans, such as student loans, that do not qualify. By understanding which debts you can write-off, you can make a better decision when trying to figure out if bankruptcy is the right choice for you.

When it soaks in that filing for personal bankruptcy, don’t use all of your retirement funds, or all of your savings to resolve insolvency or pay creditors. You should never touch your retirement accounts, unless you have absolutely no choice. Although you may need to tap into your savings, you should not use up all of it right now and jeopardize the financial security of your future.

Find a bankruptcy attorney who offers free consultations, and ask lots of questions. Seek free consultations from a handful of lawyers, before deciding which one to hire. Only make your decision if all your questions and concerns are adequately addressed. It is not necessary to make a final decision right away. So you have sufficient time to speak with a number of lawyers.

Educate yourself about the bankruptcy process. You can increase your knowledge of the bankruptcy process by conversing with a bankruptcy attorney or by carrying out independent research on the internet. Whichever method you chose to increase your knowledge of the bankruptcy process, it is vital that you comprehend how filing for bankruptcy will affect yourself, your family and your creditors.

Filing for bankruptcy will not only just stop credit card companies from harassing you about debt. It will wipe out many of your debts, which may include utility company bills, wage garnishment and foreclosure. It will reduce all of these debts down to zero, and you will have to rebuild your credit all over.

Before you file for personal bankruptcy, be sure that you are cognizant of all current laws. It can be tough to keep up with them on your own, and because they change often, a bankruptcy attorney can help you keep track for the sake of your filing process. Your state’s website should have the information that you need.

If you are unsure about the paperwork that you need to bring with you when you meet with an attorney, ask. Also, inquire as to whether the lawyer you are meeting with offers free consultations. You do not want to be surprised by a large fee just for them taking a look at your case.

Once you clear the hurdle of filing for bankruptcy, live a little, but not too much. A lot of debtors usually get stressed when they file. This stress could actually cause depression, if you don’t combat it. Bankruptcy is hard to go through, but you must remember that a less stressful, more enjoyable life is waiting on the other side of it.

Do not cosign on any type of loan during or after your bankruptcy. Because you cannot file for bankruptcy again for many years, you will be on the hook for the debt if the person for whom you are cosigning is unable to meet his or her financial obligation. You must do whatever you can to keep your record clean.

If you are over the age of 55 and filing for bankruptcy, you are not alone. In fact, this age bracket is the most likely to file. Luckily, retirement savings held in retirement accounts and IRAs are not in danger of being depleted in bankruptcy filings under one million dollars.

Familiarize yourself with the requirements for different types of personal bankruptcy so, you can decide which type is most appropriate for you. Chapter 7 bankruptcy offers low-income debtors the ability to liquidate their assets to repay debts. Chapter 13 requires you to have a steady source of income so, that you can repay debts over time.

Before filing for bankruptcy, keep in mind that child support will not be discharged in a bankruptcy case. The reason for this is that child support is a responsibility that a parent must pay. Bankruptcy does not remove that responsibility. Be sure to include any child support in your list of debts that will remain with you after the bankruptcy is discharged.

Include your entire financial information when you file for bankruptcy. If the court thinks you are attempting to conceal information, your petition could be denied. It is better to have something on there that you are unsure about, rather than not include it at all and risk a dismissal. When it comes to the types of things you might not be thinking about adding, just think about any automobiles you have, any money under the table you’re making, etc.

One way that many people have been able to avoid personal bankruptcy is to consolidate debt. Often, people have accumulated many small debts that can be extremely difficult to pay at the same time. If you can consolidate these debts along with larger ones into one debt, it is much easier to avoid bankruptcy.

A good personal bankruptcy tip is to take it all in stride. You have to remind yourself that you aren’t alone by having to file for bankruptcy. Many other people have found themselves in this situation and a lot of them are probably willing to offer you some form of guidance.

If you are having trouble getting a loan after having filed for bankruptcy, do not make the mistake of trying to get a payroll advance loan. These loans charge ridiculously high interest rates and there is a strong likelihood that you could end up going back into debt as a result.

You may know someone who has filed for bankruptcy, and have seen that the process is detailed and complex. The information in this article has, hopefully, shed more light on the process of personal bankruptcy, so that you can make an informed decision about whether bankruptcy is the solution to your financial woes.

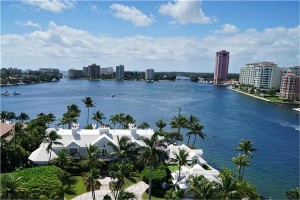

The spectacular Atlantic Ocean, stunning beaches, social occasions and fashionable museums are some of the components that make up an energetic social life in Boca Raton, Florida. As you could see, there are numerous reasons why individuals would certainly wish to move to Boca Raton, Florida.

The spectacular Atlantic Ocean, stunning beaches, social occasions and fashionable museums are some of the components that make up an energetic social life in Boca Raton, Florida. As you could see, there are numerous reasons why individuals would certainly wish to move to Boca Raton, Florida. Many people think that filing for personal bankruptcy is very complicated and difficult, but you can find many books and other resources to help you navigate through the process. If you are a reside in the state of Wisconsin consider speaking with a

Many people think that filing for personal bankruptcy is very complicated and difficult, but you can find many books and other resources to help you navigate through the process. If you are a reside in the state of Wisconsin consider speaking with a