Understanding the fundamentals of mortgages can significantly impact your journey to homeownership. With the right knowledge, you can navigate the complexities of the mortgage market confidently. Let’s delve into the essential insights you’ll gain from this guide.

What You Will Learn

- A mortgage is a legally binding agreement that allows you to borrow money to buy a home, using the property as collateral.

- Familiarizing yourself with key mortgage terms like principal, interest, and amortization will empower you in the mortgage process.

- Interest rates significantly affect your mortgage payments; understanding how they work helps you make informed decisions.

- A mortgage broker can be a valuable ally in securing a loan, providing personalized advice and access to multiple lenders.

- Being well-prepared with required documentation can streamline your mortgage application and reduce stress.

- Exploring funding options like Home Equity Lines of Credit (HELOC) can provide flexibility in managing your finances as a homeowner.

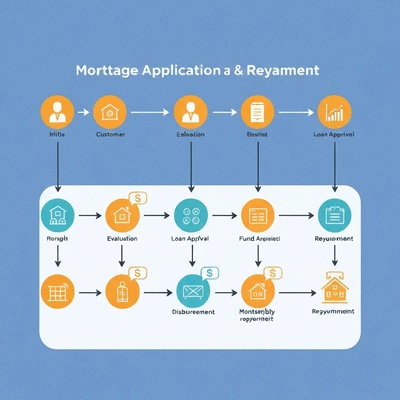

Mortgage Fundamentals: Key Terms & How They Work

This visual breaks down essential mortgage terms and outlines the basic process of obtaining a mortgage.

Key Mortgage Terms

- Principal: Original loan amount.

- Interest: Cost of borrowing money.

- Amortization: Gradual loan payoff.

- Escrow: Funds held by a third party.

How Mortgages Work

- Apply for a mortgage.

- Lender evaluates finances.

- Lender provides funds.

- Repay loan with interest.

Understanding the Fundamentals of Mortgages

When it comes to buying a home, understanding mortgages is essential. So, what exactly is a mortgage? In simple terms, a mortgage is a loan specifically designed for purchasing real estate. It allows you to buy a home without needing to pay the entire amount upfront. Instead, you make monthly payments over time, often spanning 15 to 30 years. Let’s explore this crucial concept further!

What Is a Mortgage? A Simple Definition

A mortgage is a legal agreement between you and a lender that gives the lender the right to take your property if you fail to repay the loan. It’s important to remember that a mortgage is not just the money you borrow; it's also tied to the property itself. This means that as a buyer, you can live in your new home while paying off the loan.

Here’s a quick summary of what a mortgage encompasses:

- The amount borrowed (the principal)

- The interest you’ll pay on that amount

- The term of the loan (how long you have to pay it back)

- Monthly payments based on the loan amount and interest rate

Key Mortgage Terms Every Beginner Should Know

Before diving deeper, it's beneficial to familiarize yourself with some key terms. Understanding this jargon will help you feel more confident as you explore your mortgage options. Here are a few terms to get you started:

- Principal: The original loan amount you borrow.

- Interest: The cost of borrowing money, expressed as a percentage.

- Amortization: The process of gradually paying off your loan through scheduled payments.

- Escrow: A financial arrangement where a third party holds funds until certain conditions are met.

Getting comfortable with these terms will make your mortgage journey much smoother. Each term plays a pivotal role in determining your mortgage cost and overall experience.

How Do Mortgages Work? The Basics Explained

At its core, obtaining a mortgage involves borrowing money from a lender to purchase a home. This is how it typically works:

- You apply for a mortgage with a lender.

- The lender evaluates your creditworthiness, financial situation, and the property.

- If approved, the lender provides you with the funds needed to buy the home.

- You agree to repay the loan over a predetermined period with interest.

Understanding these steps can help you prepare for the mortgage process ahead. If you have any questions about how mortgages work or need guidance, feel free to reach out to me at HomeMortgage-Guide.org. I’m here to help!

The Role of Interest Rates in Mortgage Costs

Interest rates play a crucial role in determining how much your mortgage will cost you over time. A lower interest rate means lower monthly payments, while a higher rate can significantly increase your total cost. Interest rates can vary based on various factors, including:

- Your credit score

- The type of loan you choose

- The length of your loan term

- Current economic conditions

Staying informed about current interest rates can help you choose the best time to lock in your loan and ensure you're getting a deal that works for your budget.

Understanding Amortization: How Your Mortgage is Paid Off

Amortization is a vital concept in mortgage financing. It refers to the breakdown of your loan repayments into principal and interest over the life of the loan. With each monthly payment, you will pay down both the principal and the interest. Here’s how it typically works:

- In the early years, a larger portion of your payment goes toward interest.

- As time goes on, more of your payment will go toward reducing the principal.

- By the end of the loan term, you will have paid off the entire amount borrowed.

This gradual process means that you’re not just watching your equity grow, but you’re also actively working toward owning your home outright!

Pro Tip

When exploring mortgage options, consider locking in your interest rate if you're satisfied with the current rate. This protects you from potential increases while you complete the home-buying process. Rates can change rapidly, so staying proactive can save you significant money over the life of your loan!

Next Steps in Your Home Loan Journey

Congratulations on taking the first steps toward homeownership! Now that you have a grasp of the mortgage landscape, it's time to focus on how to secure the right loan for your needs. Here are some resources to guide you in finding the right lender:

- Online directories and reviews

- Local real estate agents who can provide recommendations

- Mortgage comparison websites that allow you to evaluate multiple offers

- Resources like HomeMortgage-Guide.org that offer educational materials and tools

By utilizing these resources, you can feel more confident in making informed decisions when selecting your lender. Remember, choosing the right lender can significantly impact your overall mortgage experience!

Resources to Help You Find the Right Lender

When searching for the right lender, it’s essential to consider a few key factors. Understanding what lenders offer can make a huge difference in your mortgage journey. Here are some tips to help you:

- Look for lenders with competitive interest rates and favorable terms.

- Check their reputation and customer reviews to ensure you’re working with a trustworthy institution.

- Evaluate their responsiveness and customer service – you want someone who will be there for you through the process!

Don’t hesitate to reach out to several lenders to compare their offerings. I recommend asking them about any hidden fees, which can make a big difference in the long run. The more information you gather, the better equipped you’ll be to make a savvy choice.

Downloadable Mortgage Application Checklist: Get Prepared

Preparing for your mortgage application doesn’t have to be daunting! To simplify the process, I’ve put together a handy mortgage application checklist that you can download. This checklist includes:

- Proof of income (pay stubs, W-2s, tax returns)

- Credit report and scores

- Information on current debts and assets

- Personal identification documents

By organizing these documents beforehand, you can speed up the application process and reduce any stress you might feel. It’s all about being prepared!

Understanding the Role of a Mortgage Broker in Your Home Buying Process

Have you considered working with a mortgage broker? A broker acts as a middleman between you and lenders, helping you navigate the sometimes overwhelming mortgage landscape. Here’s what you can expect from a broker:

- Personalized advice based on your financial situation

- Access to a wider range of lenders and loan products

- Assistance with paperwork and communication throughout the process

- Negotiation on your behalf to secure better terms

Working with a mortgage broker can save you time and help you find a loan that fits your unique needs. They are there to help you every step of the way, ensuring you feel supported throughout your home loan journey.

Common Questions About Mortgages Answered

As a seasoned mortgage education specialist, I often hear common questions that potential homeowners have. Let’s tackle some of these inquiries to help you feel more informed and secure.

How Much Down Payment Do I Need to Avoid PMI?

Many of you might be wondering about Private Mortgage Insurance (PMI) and how it affects your home loan. Generally, if you can put down at least 20% of the home’s purchase price, you can typically avoid PMI altogether. This insurance protects the lender in case you default on your loan.

If saving that much seems daunting, don’t worry! There are loan options available that allow for lower down payments but come with PMI. Understanding your financial situation can help determine the best strategy for you.

What Documents Will Lenders Require for a Mortgage?

Every lender has slightly different requirements, but you can expect to provide a standard set of documents, including:

- Proof of income (such as pay stubs and tax returns)

- Bank statements

- Credit history and scores

- Identification and proof of residency

Having these documents ready will make your application process smoother, allowing for quicker approval. Remember, the more organized you are, the less stressful this part of the journey will be!

What Should I Expect During the Closing Process?

The closing process is the final step in your home buying journey, and it can feel overwhelming. However, understanding what to expect can make it easier. Here’s a quick overview:

- Review and sign a mountain of paperwork

- Pay closing costs (which may include fees for processing, title insurance, and more)

- Receive the keys to your new home!

It’s an exciting time, so embrace the process! I recommend reaching out to your lender or real estate agent if you have questions during closing.

What Are Mortgage Points and How Can They Affect Your Loan?

Mortgage points can be a confusing topic, but they’re essential to understand. Essentially, mortgage points are fees paid directly to the lender at closing in exchange for a lower interest rate. Here’s how they work:

- 1 point = 1% of your loan amount

- Paying points can reduce your monthly payment over the life of the loan

- Consider your long-term plans; if you stay in your home long enough, paying points may save you money

Evaluating whether to pay points depends on your financial situation and how long you plan to stay in your home.

Frequently Asked Questions (FAQs)

- What is a mortgage? A mortgage is a loan used to purchase real estate, where the property serves as collateral, and payments are made over a set period.

- What are the key terms in a mortgage? Key terms include principal (original loan amount), interest (cost of borrowing), amortization (gradual loan payoff), and escrow (funds held by a third party).

- How do interest rates affect my mortgage payments? Lower interest rates result in lower monthly payments and a reduced total cost of the loan, while higher rates increase these amounts.

- What is amortization? Amortization is the process of paying off a loan over time, where each payment covers both interest and a portion of the principal. Initially, more goes to interest, then more towards principal.

- How can a mortgage broker help me? A mortgage broker acts as an intermediary, offering personalized advice, access to various lenders and loan products, and assistance with paperwork and negotiations to secure better terms.

- What documents do I need for a mortgage application? Typically, you'll need proof of income (pay stubs, W-2s, tax returns), bank statements, credit history and scores, and personal identification documents.

- How much down payment is needed to avoid PMI? Generally, a down payment of at least 20% of the home's purchase price can help you avoid Private Mortgage Insurance (PMI).

- What are mortgage points? Mortgage points are fees paid directly to the lender at closing in exchange for a lower interest rate. One point equals 1% of the loan amount.

Taking Action: Your Path to Homeownership

Now that you have a better grasp on these key aspects, let’s talk about taking actionable steps toward homeownership!

Using Our Interactive Mortgage Calculators for Your Budget

At HomeMortgage-Guide.org, we offer interactive mortgage calculators that can help you assess your budget and understand what you can afford. These tools allow you to:

- Calculate monthly payments based on different loan amounts

- Estimate your potential down payment and PMI costs

- Evaluate how different interest rates affect your payment

Using these calculators can empower you to make informed decisions about your mortgage options! For a comprehensive toolkit on home loans, consider exploring resources like the Consumer Financial Protection Bureau's Home Loan Toolkit, which provides valuable information for homebuyers.

Contacting a Mortgage Broker: What to Ask

Connecting with a mortgage broker can simplify your journey, but knowing what to ask is crucial. Here are a few questions to consider:

- What loan products do you recommend based on my financial situation?

- How do you get paid, and what fees should I expect?

- Can you provide references from past clients?

These questions can help you gauge their expertise and ensure you’re making the right choice for your mortgage journey. You can also find additional information on important consumer protections and considerations regarding home loans from the Federal Reserve.

Exploring Home Equity Lines of Credit (HELOC) as a Funding Option

Finally, let’s explore the concept of a Home Equity Line of Credit (HELOC). It’s a valuable funding option for homeowners looking to tap into their home equity. Here’s what you should know:

- A HELOC allows you to borrow against the equity in your home, providing flexible funding.

- Interest rates are often lower than personal loans, making it an attractive option.

- You can use a HELOC for various purposes, such as home improvements or consolidating debt.

As you navigate your financial options, consider whether a HELOC might be a smart fit for your needs. Always consult with a financial advisor or mortgage professional before making any decisions! For those interested in the tax implications of homeownership and related financial products, the IRS offers Publication 936, which details home mortgage interest deductions.

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- A mortgage is a loan specifically designed for purchasing real estate, allowing buyers to make monthly payments over time.

- Key mortgage terms to understand include principal, interest, amortization, and escrow.

- Interest rates significantly affect mortgage costs; lower rates can lead to lower monthly payments.

- Amortization refers to the gradual repayment of the loan, with a shift from interest to principal over time.

- Researching lenders and comparing offers can lead to better mortgage terms and rates.

- Having required documents ready, such as proof of income and identification, can streamline the mortgage application process.